Operators are focussing on Intelligent Plant Analysis, A greater uptake of Flare gas and Flash gas recovery technologies, compact separation systems.

Innovative thinking on use of low cost FPSO’s, removing the need for a rotating turret and the subsequent complications of swivel mechanisms when adopting future electrification upgrades, digital twin technology being applied in new ways for methane measurement as well as digital models and data storage. growing adoption of low carbon power technologies to be more energy efficient, and greatly reduce carbon emissions, novel concepts emerging such as Waste Heat recovery and Wave energy Generation being added into the mix this year.

Low cost wellhead platforms for marginal developments, onshore smart rooms for remote operations of unmanned facilities, novel personnel transport systems such as dedicated Walk to Work vessel. Greater adoption of NII technologies such as hard to reach area inspections for cargo tanks, remote UT and sensor arrays, Corrosion under insulation, predictive analytics to improve plant efficiency, and adoption of electrification enabling Technologies.

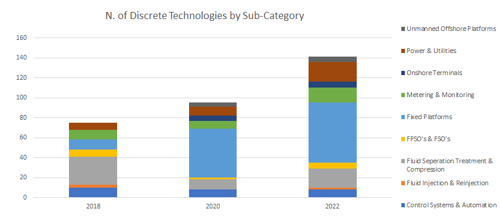

Summary Findings (Click on Sub-Categories for detail)

- Control systems and automation

In this sub-category Operators are focussing on Intelligent Plant Analysis, Retrofit Gas Turbine Controls, use of AI and Machine learning for analytics and event detection, DSC systems and Automated Control Systems - Fluid injection and reinjection

In this Sub Category operator focus is on a small number of technologies reported by operators this year including chemical dosage testing, and produced water and CO2 re-injection technologies, although the number of individual technologies is small, some are used on multiple assets - Fluid separation, treatment and compression

Operators technology plans for 2022 show a greater uptake of Flare gas and Flash gas recovery technologies, membrane and compact separation systems, Chemicals for heavy/light oil mixtures where an operator is integrating a new heavy oil tieback to existing light oil facilities, more efficient valve technologies - FPSOs and FSOs

Operators technology plans for 2022 show innovative thinking on use of low cost FPSO’s, removing the need for a rotating turret and the subsequent complications of swivel mechanisms when adopting future electrification upgrades, digital twin technology being applied in new ways for methane measurement as well as digital models and data storage. - Metering and monitoring

Operators technology plans for 2022 show operator focus is on more sophisticated methods of emissions monitoring including use of AI, and improved detection methods, also automated valve monitoring systems for remote operations. - Power and utilities

Operators technology plans for 2022 show growing adoption of low carbon power technologies to be more energy efficient, and greatly reduce carbon emissions, novel concepts emerging such as Waste Heat recovery and Wave energy Generation being added into the mix this year - Unmanned offshore platforms

Operators technology plans for 2022 show a growing requirement for low cost wellhead platforms for marginal developments, onshore smart rooms for remote operations of unmanned facilities, novel personnel transport systems such as dedicated Walk to Work vessels - Fixed Platforms

Operators technology plans for 2022 show greater adoption of NII technologies such as hard to reach area inspections for cargo tanks, remote UT and sensor arrays, Corrosion under insulation, predictive analytics to improve plant efficiency, and adoption of electrification enabling Technologies

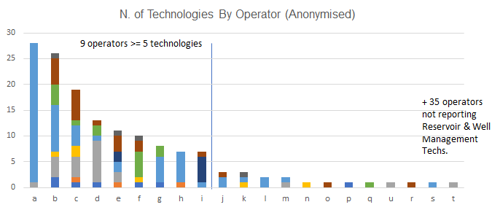

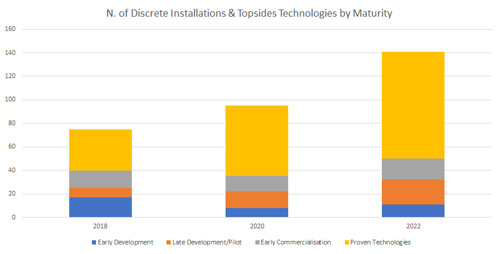

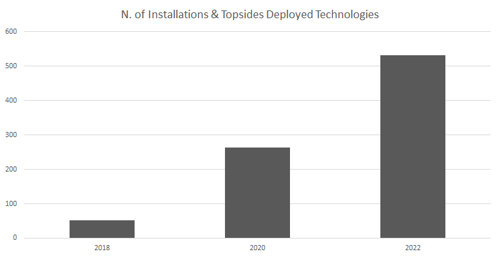

Installation & Topsides technologies

- Over 50 technology plans submitted each year from 2018 to 2022

- Steady Increase in number of individual technologies, once adopted a greater number of assets are using the technologies (Participation of 22 operators in 2022)

- A number (30) of respondents not yet considering this theme (based on submissions)

- Operators are focusing on a number of technologies ready for deployment (Early Commercialisation TRL 8) and Existing or in widespread use (TRL 9)

- The pipeline of technologies under development (TRL 1-7) remains healthy

Evidence of maturity and deployments

Once familiar with the technology the same operator deploys it at multiple assets (over 500 deployments reported/planned for 2021-23)

1. Control Systems & Automation

In this sub-category Operators are focussing on Intelligent Plant Analysis, Retrofit Gas Turbine Controls, use of AI and Machine learning for analytics and event detection, DSC systems and Automated Control Systems.

- Intelligent Plant "Alarm Analysis Pro" app - Tool to analyse nuisance alarms coming in to control room and helps resolve issues with control system alarms.

- Repsol Sinopec Resources (Arbroath, Montrose) TRL9 Proven Technologies

- Retrofit gas turbine controls - Retrofit gas turbine controls plus removing obsolete items on package. More feedback into control system - provides greater feedback loop. Can add parts that move components for preservation reasons

- Shell (Arran, Fram, Shearwater, Merganser) TRL9 Proven Technologies

- DCS upgrade - The Triton DCS system currently comprises a mixture of Honeywell Experion PKS, Honeywell C200 & C300 Process Controllers, Allen Bradley PLC-5 PLC's together with associated IT/coms infrastructure and interfaces to other ICSS systems. As part of Dana Petroleum's 5-year obsolescence review cycle, the Triton DCS systems were reviewed and was deemed to have widespread obsolescence. Dana are undertaking a brownfield change-out / upgrade to address these issues

- KNOC/Dana (Bittern, Clapham, Guillemot, Pict & Saxon) TRL9 Proven Technologies

- Automatic Control System (ACS) – Automation of ESP operations, automated control systems to operate ESP’s Automatically.

- Equinor (Mariner) TRL9 Proven Technologies

Technology Example :

Automatic Control Systems –ABB Automated Control system for ESP’s

View Technology

- Ambrit - Improve accuracy of metering information onshore to improve condition monitoring and accuracy of metering data

- Harbour Energy (Brittania, Calder, Everest, Fleming) TRL 5-7 Late Development/Pilot

- Weidmuller Analytics - machine learning software - Proof of concept that machine learning can highlight areas for improvement and potential diagnose very early event detection

- Apache (Beryl) TRL 1-4 Early Development

2. Fluid Injection & Re-injection

In this Sub Category operator focus is on a small number of technologies reported by operators this year including chemical dosage testing, and produced water and CO2 re-injection technologies, although the number of individual technologies is small, some are used on multiple assets

- Amine Vent Capture & Sequestration - Capturing the CO2 from the Amine Vent on the Elgin PUQ and injecting into nearby reservoir

- TotalEnergies (Elgin) TRL 9 Proven Technologies

- Corrosion Inhibitor Dosage System - "CoMIC is a technology that provides information on optimal dosage of corrosion inhibitors by measuring micelle concentration. Benefits include increased asset integrity, reduced pipeline inspections, potential chemical cost reduction."

- Shell (Gannet A, B, C, D, F & G) TRL 9 Proven Technologies

- Produced water re-injection - Produced water reinjection, (NSTA information - (PWRI) is a method for eliminating the environmental impact of discharging produced water at offshore oil production sites. Reinjection of produced water has been carried out on several locations around the world. In most cases the activities have been concentrated on individual wells and have not included mixing the produced water with seawater prior to injection).

- CNR International (Tiffany) TRL 9 Proven Technologies

Technology Example :

Anpera Technologies third generation of CoMic™Micelle analysis system. provides results rapidly in the field. The data is easily integrated into databases, archives and visualisation software

View Technology

- Note Operators not reporting Emerging Technologies in this sub category

3. Fluid Separation, Treatment & Compression

Operators technology plans for 2022 show a greater uptake of Flare gas and Flash gas recovery technologies, membrane and compact separation systems, Chemicals for heavy/light oil mixtures where an operator is integrating a new heavy oil tieback to existing light oil facilities, more efficient valve technologies

- Gas Recovery to Reduce Flaring – Reduction to the flare waste stream via recovery of gas back into the process stream. specialized compression packages, which aim to recover and repurpose emissions that would normally be burned during the flaring process.

- KNOC/Dana (Bittern, Guillemot, Clapham, Pict & Saxon), TotalEnergies (Alwyn North, Ballindalloch, Culzean, Gryphon) ) TRL9 Proven Technologies

- KNOC/Dana (Bittern, Guillemot, Clapham, Pict & Saxon), TotalEnergies (Alwyn North, Ballindalloch, Culzean, Gryphon) ) TRL9 Proven Technologies

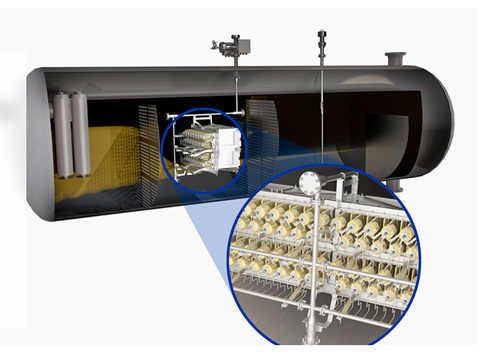

- VIEC Enhanced Oil/Water separation - Electrostatic coalescing technology that is installed inside an oil/water separator

- Shell (Penguins East, Penguins West) ) TRL9 Proven Technologies

- Shell (Penguins East, Penguins West) ) TRL9 Proven Technologies

Technology Example :

Sulzer’s electrostatic coalescer internals for vessels VIEC™ Processing technology for oil and gas upstream operations. The solution can improve productivity and separation efficiency.

View Technology

- Eductor Vapour Recovery - Reduce the CO2 footprint from Flaring of process flash gas. Use of the latest Eductor Vapour Recovery Compression tech to capture flash gas to reduce flaring.

- Harbour Energy (Fleming) TRL9 Proven Technologies

- Harbour Energy (Fleming) TRL9 Proven Technologies

- Low Shear Valves - Control valve that minimizes mixing energy. Inline and angle type. Leaves droplets intact to improve performance of subsequent separation / treatment.

- Shell (Fram, Merganser, Shearwater, Starling) ) TRL9 Proven Technologies

- Shell (Fram, Merganser, Shearwater, Starling) ) TRL9 Proven Technologies

- Ceramic based static / passive membrane filtration system - A commercial ceramic based static / passive membrane system, developed by Rena Quality Group, which will allow offline oil removal from produced water.

- KNOC/Dana (Bittern, Guillemot, Clapham, Pict & Saxon) TRL 8 Early Commercialisation

- KNOC/Dana (Bittern, Guillemot, Clapham, Pict & Saxon) TRL 8 Early Commercialisation

- Stemless Valves - Axial flow stemless valves could remove fugitive emission and the reliability and integrity issues associated with a conventional valve. Also, they may reduce flow-induced instability in some services .

- Harbour Energy (Calder, Dalton, Everest, Fleming, Jade, Judy Jasmine) TRL 8 Early Commercialisation

- Harbour Energy (Calder, Dalton, Everest, Fleming, Jade, Judy Jasmine) TRL 8 Early Commercialisation

- Chemicals to manage heavy/light oil mixture - Chemicals to manage heavy/light oil mixture - Developing a new family of chemicals, which the aim of combating a unique issue of mixing existing light oil with a new heavy oil tieback.

- KNOC/Dana (Bittern, Guillemot, Clapham, Pict & Saxon) TRL 5-7 Late Development/Pilot

- Compact separation - Compact separation technology ("Moseley Separator") potential study for inclusion into projects to low cost, size and weight

- Harbour Energy (Calder, Dalton, Everest, Fleming, Jade, Judy Jasmine) TRL 1-4 Early Development

Other Technologies in this sub-category include: Wireline Technologies such as WellAnt Abrasive Cutting tool for well bore obstructions, Razor multi purpose tool to bridge plugs, stroker, punch and cutter Rigidlock Deepwater wellheads, and Realtime Coil tubing for data collection during interventions.

4. FPSO’s & FSO’s

Operators technology plans for 2022 show innovative thinking on use of low cost FPSO’s, removing the need for a rotating turret and the subsequent complications of swivel mechanisms when adopting future electrification upgrades, digital twin technology being applied in new ways for methane measurement as well as digital models and data storage.

- Sevan 400 Cylindrical FPSO - Adopt Sevan 400 FPSO design for Penguins project to remove the need for turret and enable project to be economically feasible

- Shell (Penguins)

- Shell (Penguins)

Technology Example :

Sevan 400 Cylindrical FPSO used for Shells Penguins field - Sevan hull design currently under construction by Shell at COOEC’s Qingdao Yard.

View Technology

- 3D Digital Twin - 3D model of the Asset (FPSO and subsea) which can be linked to data warehouse so ensure visualisation and storage of documents

- Shell (Penguins)

- Microsoft 4.0 - Digital twin technology for methane measurement of equipment types on the FPSO

- BP (Schiehallion)

- Use of Temporary repair patch for Hull repair scopes - To allow for repair of hole in FPSO hull, a temporary patch installed by ROV was used to allow for welding repair within the FPSO tank.

- Neo Energy (Donan - Maersk)

- Min Cost FPSO - Minimum cost floating production facilities for marginal fields WOS including production buoys and small FPSOs

- Harbour Energy (Calder, Dalton, Everest, Fleming, Jade, Judy Jasmine) TRL 8 Early Commercialisation

- iHawk - 3D photogrammetry model of external structures using drone technology on FPSO’s

- TotalEnergies (Gryphon) TRL 8 Early Commercialisation

- Diverless I-Tube integrity scans - the AOC subsea team together with a selected vendor developed a diverless method by constructing multiple sleeves that join and fit into the I-Tube that can incorporate a UT and scanning tool. This will be dropped down the I-Tube and sleeves will bridge the gap between the upper and lower I-Tubes allowing the tool to reach that un-accessible section to carry out the scans.

- Anasuria Operating Company (Guillemot A, Teal, Teal South) TRL 5-7 Late Development/Pilot

5. Metering & Monitoring

Operators technology plans for 2022 show operator focus is on more sophisticated methods of emissions monitoring including use of AI, and improved detection methods, also automated valve monitoring systems for remote operations.

-

- PEMS Systems - Use Predicate emission monitoring + streamlined reporting to improve accuracy of emission reporting from combustion plant and flare

- Harbour Energy (Brittania, Calder, Dalton, Everest, Fleming, Jade, Judy Jasmine)

- Harbour Energy (Brittania, Calder, Dalton, Everest, Fleming, Jade, Judy Jasmine)

Technology Example :

ABB PEMS to improve efficiency and streamline emmissions reporting. ABB offer the PEMS solution

View Technology

- NIR Spectral Analysis offshore - Lab studies and field trials to establish the potential to utilise NIR Spectral analysis characterisation of production stream crudes for hydrocarbon characterisation, stream allocation and cell stock management

- Apache (Beryl, Corona)

- FPSO stress monitoring gauges - Gauges have been installed along the FPSO to monitor and record vessel stresses in sea states experienced West of Shetland. This data assists in integrity management of the FPSO hull, whiles also helps in the refinement of the design of future FPSOs to be deployed in similar harsh weather locations.

- Hurricane Energy (Lancaster)

- SmartMix Oil Metering Upgrade - Upgrade of Bittern, Guillemot West Test oil metering to 32-path M&T DFX Ultrasonic Flow Meters to improve accuracy. The SmartMix Technology utilises a unique liquid jet in cross flow (LJICF) configuration, provides superior and efficient mixing, which in turn delivers practically infinite turndown in flow rates while also ensuring zero pressure drop.

- KNOC/Dana (Barra, Bittern, Guillemot, Clapham, Pict & Saxon)

- Methane Drone survey - Use of remote systems e.g. drones to collect data on unburnt hydrocarbons/methane and fugitives

- Harbour Energy (Brittania, Calder, Dalton, Everest, Fleming, Jade, Judy Jasmine) TRL 8 Early Commercialisation

- Emissions.AI - Implementation of Emissions.AI as part of the Dana emissions reduction programme. This tool will work in tandem with other OPEX group tools already in operation, and includes emissions associated with plant operation (Energy Efficiency) as well as those associated with operational flaring.

- KNOC/Dana (Barra, Bittern, Guillemot, Clapham, Pict & Saxon) TRL 8 Early Commercialisation

- PEMS Systems - Use Predicate emission monitoring + streamlined reporting to improve accuracy of emission reporting from combustion plant and flare

- MCR Valve Watch - ValveWatch is an automated, online valve monitoring system for critical valves and actuators. Users can remotely monitor a valve or actuator’s performance and correct degradation before it affects safe and reliable operation. ValveWatch incorporates sensors attached to or near the valve and actuator assembly to routinely monitor and record their performance. This innovative technology gives operators the ability to trend valve seal performance and proactively plan for maintenance or repair.

- Shell (Barque, Brigantine, Caravel, Carrack, Clipper, Corvette, Cutter, Galleon) TRL 5-7 Late Development/Pilot

6. Power & Utilities

Operators technology plans for 2022 show growing adoption of low carbon power technologies to be more energy efficient, and greatly reduce carbon emissions, novel concepts emerging such as Waste Heat recovery and Wave energy Generation being added into the mix this year

- Helix Wind turbine – Adding a wind turbine to a Hybrid Power System to reduce the running hour of the back-up diesel generator

- Shell (Barque, Brigantine, Caravel, Carrack, Clipper, Corvette, Cutter, Galleon) TRL 9 Proven Technologies

- Shell (Barque, Brigantine, Caravel, Carrack, Clipper, Corvette, Cutter, Galleon) TRL 9 Proven Technologies

- Hybrid power system - Hybrid power system providing a maintenance free solution in the form of solar panels, providing power to the platform whilst chargin, g batteries. Two small lean-burn diesel-engine driven generators will provide energy in case the renewable system fails.

- Shell (Barque, Brigantine, Caravel, Carrack, Clipper, Corvette, Cutter, Galleon) TRL 9 Proven Technologies

- Shell (Barque, Brigantine, Caravel, Carrack, Clipper, Corvette, Cutter, Galleon) TRL 9 Proven Technologies

- Pilotless Gas Turbine Burners - Coking in the GT burners and burner pilot blockages causes significant issues on power generation reliability on Lomond and North Everest Gas Turbines (GTs). This leads to significant cost to maintaining the packages due to frequent burner change-outs when running on liquid fuel additionally it is driving the need to have additional generation online leading to higher emissions than required to provide power on Lomond and North Everest.

- Harbour Energy (Lomond, North Everest) TRL 9 Proven Technologies

- Low Carbon Power Solutions - Review wind power solutions & grid connection for the CNS as part of a collaborative effort with energy suppliers and other operators

- Apache (Forties) TRL 9 Proven Technologies

- Platform Electrification (Power Supply) - Development of grid tie-in, conversion of AC to HVDC for transmission in a subsea HVDC cable to an offshore sub-station

- Harbour (Jasmine), TotalEnergies (Culzean, Elgin) TRL 8 Early Commercialisation

- Electrification of Asset via Floating Wind Solution – INTOG for Elgin and Partial electrification of asset with a floating wind power source for Culzean

- TotalEnergies (Culzean, Elgin) TRL 8 Early Commercialisation

- Eco Gen WHR to Power - Currently all the waste heat from the simple cycle GTs goes to the atmosphere that could potentially be used to generate electrical power. the challenge do this economically on a brownfield asset. Eco Gen is an offering from Siemens that may be a compact engine to economically deploy offshore.

- Harbour Energy (Brittania) TRL 5-7 Late Development/Pilot

- Harbour Energy (Brittania) TRL 5-7 Late Development/Pilot

Technology Example :

The Innovation and Targeted Oil and Gas (INTOG) leasing round is a process by which developers will apply for the rights to build offshore wind farms specifically to provide low carbon electricity to power oil and gas installations to decarbonise oil and gas operations and enable innovative projects

View Technology

- Wave Energy Convertor (WEC) - Innovative system for generating electricity from ocean waves

- Shell (Barque Brigantine, Caravel, Carrack, Clipper, Corvette, Cutter, Galleon) TRL 1-4 Early development

7. Unmanned Offshore Platforms

Operators technology plans for 2022 show a growing requirement for low cost wellhead platforms for marginal developments, onshore smart rooms for remote operations of unmanned facilities, novel personnel transport systems such as dedicated Walk to Work vessels

- Onshore Smart Rooms – Onshore Smart Rooms connected to Offshore Control Rooms

- TotalEnergies (Alwyn North, Dunbar, Ellon, Forvie, Grant, Islay, Nuggets)

- Walk to work - heave compensated platform - Use of walk to work technology utilising a heave compensated platform sited on the back of a surface vessel to provide an alternative means of accessing the platform or SPM.

- Apache (Beryl)

- Apache (Beryl)

Technology Example :

The Ampelmann system combined with this vessel is an alternative solution to support installation, maintenance, upgrading and life extension for offshore wind and oil and gas platforms and (aging) production facilities, as from 30 miles offshore.

View Technology

- Remote Operations - Remote operated platform from onshore control room

- Neo Energy (Babbage)

- 3D Mapping - The 3D mapping of the platform employs the use of a laser scanner to photograph and map all areas of the platform. The mapping is of such precision that surveys for installing new equipment can be conducted from onshore using the model that is produced. It also allows a small window to conduct visual integrity inspections, thereby reducing personnel on the platform and subsequently, risk to personnel.

- Ineos (Breagh, Clipper)

- Min Cost wellhead platform - Self installing or Rig installed minimum facilities well head platforms for UHTHP developments

- Harbour Energy (Brittania, Calder, Dalton, Everest, Fleming, Jade, Judy Jasmine) TRL 8 Early Commercialisation

- Note: There are no reported Emerging Technologies for this sub-Category

8. Fixed Platforms (Manned Offshore Platforms)

Operators technology plans for 2022 show greater adoption of NII technologies such as hard to reach area inspections for cargo tanks, remote UT and sensor arrays, Corrosion under insulation, predictive analytics to improve plant efficiency, and adoption of electrification enabling Technologies

- IRIS Upgrade - Updated Incident reporting system including action tracking and learning

- BP (Andrew) TRL 9 Proven Technologies

- Predictive Analytics for Plant Monitoring - Use of a third party vendor using data to improve plant efficiency / prevent trips

- BP (Clair) TRL 9 Proven Technologies

- 3D Model Digital Twins - Develop a fully integrated 3D model based Asset Management system/platform that enables efficient and effective visualisation of equipment characteristics, using a digital twin philosophy. The system will provide a visual hub, containing tag specific geo-locations, to which multiple sources of engineering data can be assigned. Type of data sources assigned to tags will include MAXIMO APM/PM/MCDR data; live PI data; as-built documentation and RBI and cumulative risk status.

- CNR International (Ninian) TRL 9 Proven Technologies

- CNR International (Ninian) TRL 9 Proven Technologies

Technology Example :

TEXO successfully pioneered a new unmanned inspection method on a major UK North Sea FPSO, delivering significant safety, time and cost saving benefits in surveying a vast oil storage tank.

View Technology

- Cargo Oil Tank Inspection Tools - Inspection tools and platforms that can reliably inspect cargo oil tanks in service. (1) Eliminate confined space entry for inspectors and (2) increased production efficiency by avoiding production slowdowns and shutdowns

- Ithaca (Alba) TRL 9 Proven Technologies

- Inductosense - remote UT & sensor Array - Reduced/removed requirement for Corrosion Coupon removal every 6 months Circa £40K per year saving. Removed requirement for Break containment permits.

- BP (Clair) TRL 8 Early Commercialisation

- Electrifying Mech GT Drivers - Once power from shore / renewable is available the GTs could be converted to high speed electrical motors. Review available feasibly to change the GTs to e-motors to reduce CO2 emissions and increase PE and lower OPEX

- Harbour Energy (Brittania, Calder, Dalton, Everest, Fleming, Jade, Judy Jasmine) TRL 8 Early Commercialisation

- Neutron Backscatter Inspection for CUI - we sought to develop a screening method to identify areas of insulated pipework most susceptible to CUI (i.e. those with presence of water in lagging). Neutron backscatter tool deployed during 2018. this includes review of value associated with Neutron Backscatter tool.

- CNR International (Ninian, Tiffany) TRL 5-7 Late Development/Pilot